Turn Five Minutes into Financial Momentum

Morning Momentum Check

Midday Micro-Audit

Receipt Sweep

Pause Before the Swipe

Evening Closure Ritual

Tiny Net-Worth Tally

Once or twice a week, log assets and debts in a simple tracker. Watch trends, not perfection. Seeing numbers move—even slightly—turns progress into feedback, which reinforces consistency and makes ambitious plans feel less abstract and more within reach.

Friction Finder

Note the exact moment money felt hard today: a confusing app, an impulse aisle, a late fee. Identify one friction you can remove tomorrow, like a default alert or prepared snack. Solve tiny blockers, and big outcomes follow naturally over time.

Automation Micro-Tweak

Spend sixty seconds moving a few dollars closer to your goals. Increase a transfer by a tiny percentage, or reroute round-ups to debt. These nudges are painless today, compounding tomorrow, and profoundly freeing when emergencies come without warning.

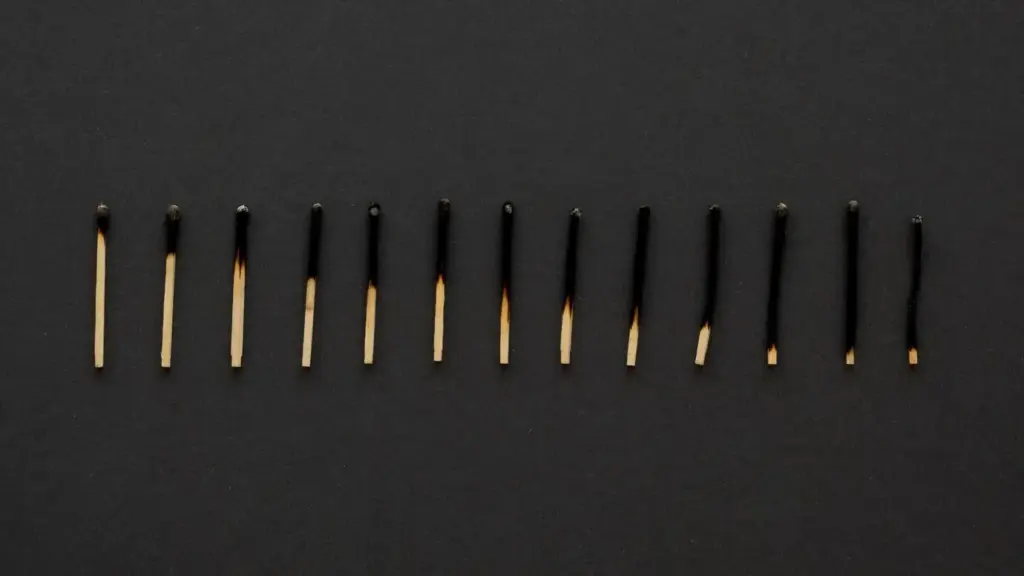

Behavior That Sticks

01

Anchor to Existing Routines

Attach each action to something stable: after brushing teeth, during coffee brewing, just before shutting the laptop. Anchoring reduces decision fatigue and turns repetition automatic, protecting attention for creativity and making the five-minute window easy to honor every day.

02

Make the First Step Effortless

Prepare a clear workspace, keep your timer handy, and set phone shortcuts for finance apps. When the barrier to starting is nearly zero, completion feels inevitable. Friction sneaks away, and your brain learns to expect a quick, satisfying win.

03

Celebrate Small, Repeatable Wins

Track streaks visibly, tell a friend, or place a sticker on your calendar. Celebration matters because your nervous system tags the habit as rewarding. Joy is practical; it keeps the ritual alive through busy seasons when motivation dips.

Stories That Changed Everything

Tools You Can Use in a Flash

The One-Page Spending Map

Draw three boxes—needs, wants, goals—and list no more than five items in each. Place it near where you decide to spend. The visual limit clarifies tradeoffs, lowers decision fatigue, and quietly nudges every dollar toward what matters most.

A Template That Speaks Plainly

Save a note with three prompts: balance check, one intention, one action. Reuse it daily without editing structure. Familiar words shorten startup time, reduce avoidance, and help track patterns that your future self can use to refine decisions.

Join the Momentum Circle

Weekly Challenge, Tiny Reward

Share Your Ritual Library

Ask for a Cheer, Offer One Back

All Rights Reserved.